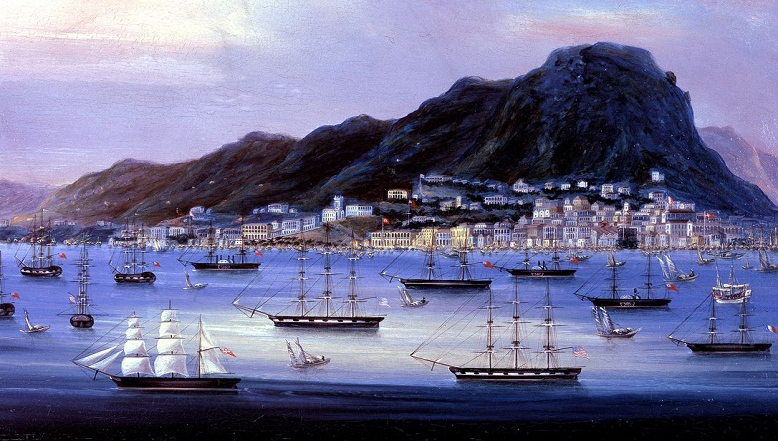

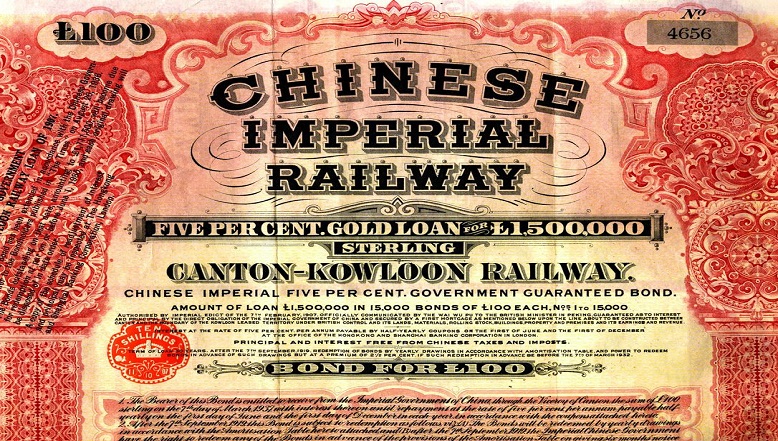

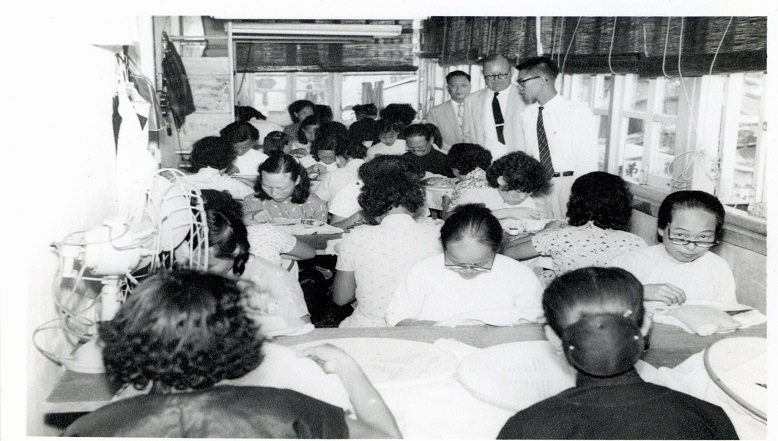

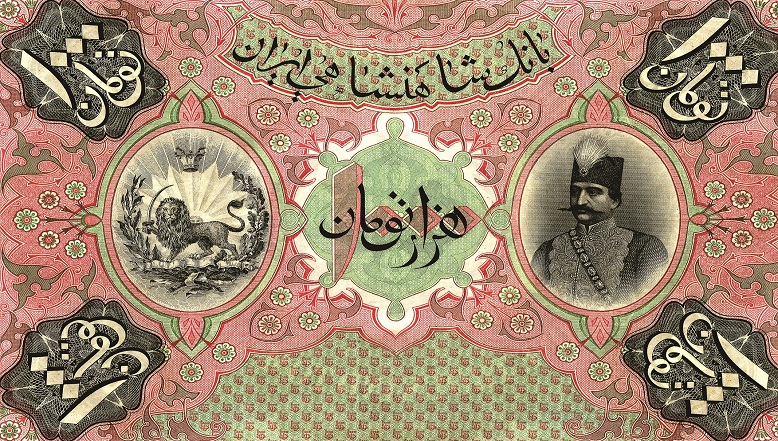

The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in the Netherlands

Our services

HSBC has been operating in the Netherlands since 1999. We are one of the world’s largest banking and financial services organisations. HSBC’s worldwide connections enable us to offer our corporate clients a global perspective combined with local knowledge and expertise.

Our corporate relationship management teams support Dutch-headquartered clients as well as overseas multinationals which have local operations or subsidiaries in the Netherlands. Our services enable corporate clients to make the most of new opportunities in foreign markets, carry out cross-border transactions and expand internationally.

As well as dedicated relationship and product teams in Amsterdam offering global payments solutions, trade and hedging services and financing, corporate clients can also access specialist and sector-specific support from teams all over the world.

Our headquarters

De entree 247-249

1101 HG Amsterdam

The Netherlands

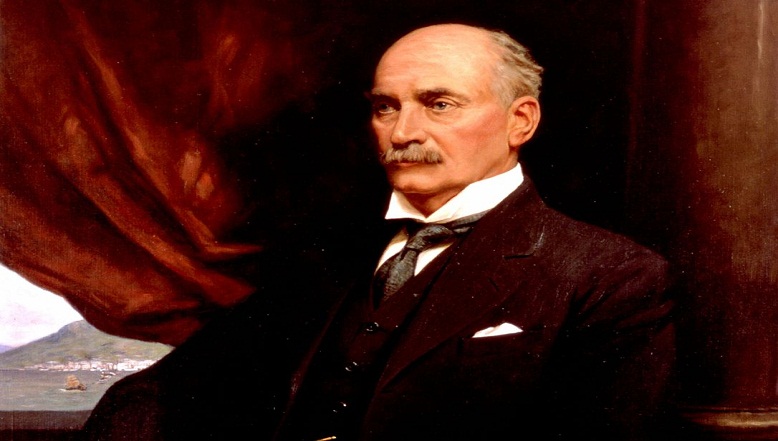

Our CEO

Annabelle Diepenhorst

HSBC Group history timeline

Sustainability is unlocking business growth Opens in new window

The commercial case for sustainability has reached a critical mass, placing it firmly on the agenda of many businesses globally, says Natalie Blyth.

Carers need more tailored financial support Opens in new window

We have a responsibility to step in and address the financial challenges faced by carers – and to help them find the tailored financial support that they need, says Steve Reay.

Younger generations investing with greater confidence Opens in new window

Younger generations of savvy, digital natives are investing in their financial futures with more confidence and control than older generations, says Jenny Wang.